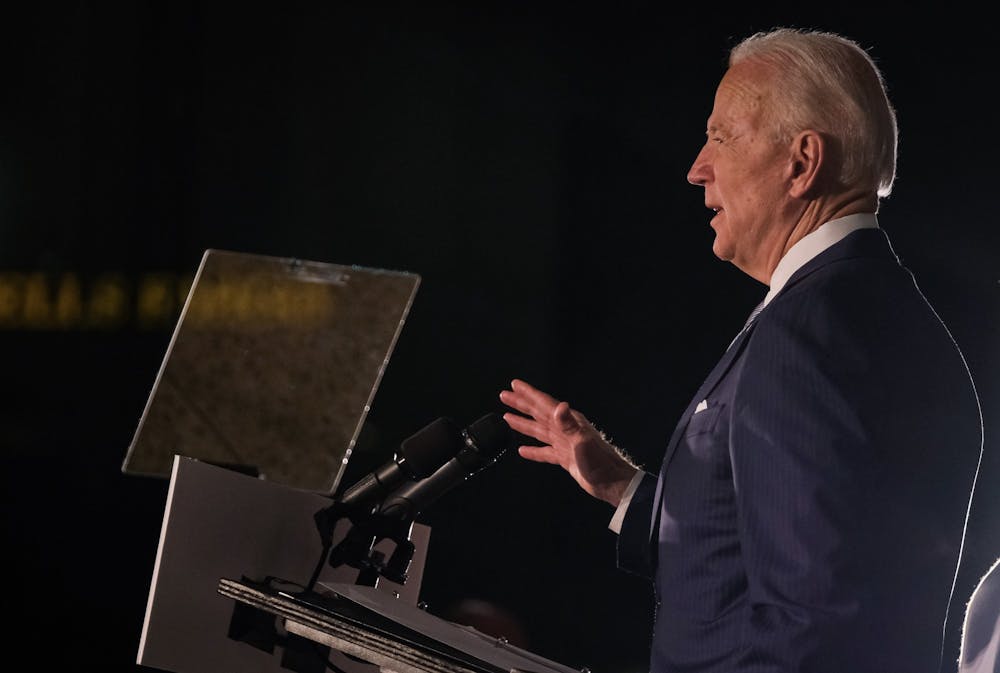

Joe Biden’s COVID-19 relief plan includes money for vaccine distribution, community support, money to improve federal cybersecurity, and direct aid.

Credit: Son NguyenPenn Wharton Budget Model’s analysis of President Joe Biden’s COVID-19 relief plan found that the package will boost the country's gross domestic product by 0.6% in 2021.

The $1.9 trillion relief package includes money for vaccine distribution, community support, improvements to federal cybersecurity, and direct aid, The Associated Press reported. Three of the plan's provisions — direct payments, expanding the Child Tax Credit, and expanding the Earned Income Tax Credit — would cost $595 billion this calendar year, the analysis found.

PWBM is a non-partisan research initiative within the Wharton School that provides an economic analysis of public policy's fiscal impact.

Their most recent report found that under Biden’s plan, 99% of households in the bottom 80% of income would receive a direct benefit. The average direct aid benefit for household in the bottom 40% of incomes would be over $3,000, according to the report.

The PWBM also predicted that 73% of the direct relief payments will go towards household savings and produce limited stimulus effects.

The PWBM estimated that the GDP in 2022 will decrease by 0.2 percent and by 0.3 percent in 2040 as a result of the increase in national debt caused by the $1.9 trillion in spending.

On Feb. 5, the Senate passed a budget bill that will help move the $1.9 trillion relief plan into action, The Washington Post reported. Democrats hope to reach final passage of relief legislation by mid-March when enhanced unemployment benefits are set to expire, the Post reported.

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

Donate