File Photo

Sixteen employees at Penn make over $1 million a year — under the new GOP tax bill five of them will be subject to a new 21 percent tax on their annual salaries.

The bill, which was passed amid tremendous controversy on Dec. 20, will have implications for Penn in a variety of different ways. While the taxation of tuition waivers — which many claimed would have made a graduate education unattainable — was not included in the final version of the bill, the 1.4 percent excise tax will directly affect Penn's multi-billion dollar endowment.

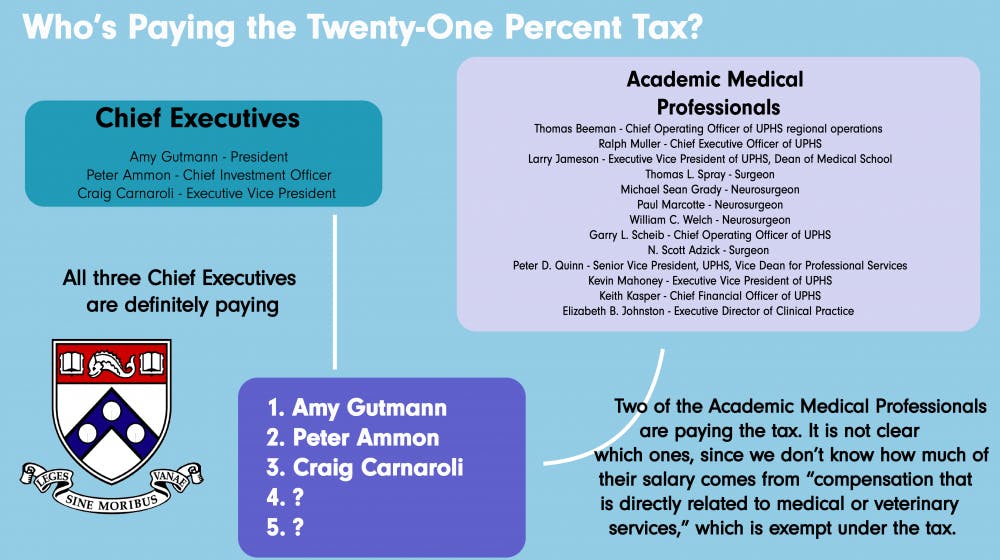

The final version also implements a tax on the annual compensation of the five highest-paid employees in nonprofit groups. It could affect academic medical professionals who make more than $1 million each year, excluding “compensation that is directly related to medical or veterinary services," according to The Chronicle for Higher Education.

At Penn, this list consists of three known executives and two unknown academic medical professionals.

Penn employs 13 academic medical professionals who could potentially qualify for the tax, the highest paid being Chief Operating Officer of the University of Pennsylvania Health System Thomas Beeman. Beeman's 2015 taxable compensation was $4,460,192, according to The Chronicle.

Gutmann is the most prominent employee who would be subject to the tax. According to 2015 statistics provided by The Chronicle for Higher Education, Gutmann’s taxable compensation for that year was $3,047,847. Under the new law, she would pay $640,047.87 in taxes — a number that is likely to increase since her salary has grown since then.

Legislators identified high-earning college executives as candidates for taxation, and National Public Radio reports that these high earnings can “stoke resentment.”

“Congress is putting nonprofits in the same position as for-profit entities when it comes to compensating employees,” tax lawyer Jonathan Sambur said. Yet according to Sambur, for-profit corporations, such as Amazon and Google, have developed ways to evade these taxes on high-earning employees.

“The way to get around this rule is to pay executives a relatively high number, but not a million dollars, and then to give them a ton of stock options and other compensation,” Sambur said.

Penn executives such as Gutmann can’t be compensated with stock options, as nonprofits can’t issue stock, Sambur said.

Gutmann’s salary is notable as one of the highest in the nation — according to records Penn filed with the Internal Revenue Service, Gutmann’s pay package in 2015 increased 6.09 percent and reached $3,537,020. Gutmann is one of only two female university presidents on NPR's list of the top 10 highest paid university presidents.

College freshman Theo Yuan supports Gutmann’s salary and said she should be rewarded for doing a “good job.”

“She raises a lot of revenue from fundraising, I don’t see why she shouldn’t get a high salary,” Yuan said.

When NPR asked Penn about the size of Gutmann’s salary, David L. Cohen, the chair of the Board of Trustees of the University of Pennsylvania, cited Gutmann’s job performance as justification for her compensation.

“Amy Gutmann's salary is based on the market that exists for research university presidents, the unique complexity of leading Penn, and the extraordinary job she has done as our President,” Cohen said to NPR. “The Trustees believe she is the best university president in the country and that her salary should rightly reflect the stellar leadership she has brought to Penn."

To Sambur, Gutmann functions like a head of a corporation and expects to be paid accordingly.

“She is no different than a CEO of a large corporation," Sambur said. "Typically, it is not surprising to see people who were in the corporate world go into the university world and expect to get compensated based on the same level of management skills that they would otherwise have."

According to a representative from the Association of American Universities, this provision of the tax law will not have a large impact on universities as a whole, and as a result, attracted few lobbying efforts.

“We just had so many other fish to fry that we've left this one up to others to deal with," Pedro Ribeiro, a spokesperson for the AAU, told CNN.

University spokesperson Stephen MacCarthy said in an emailed statement to The Daily Pennsylvanian that Penn did not comment on this new tax.

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

Donate