Six weeks into her senior year at Penn, Rachel found out herwork-study grant was gone. Rachel, a College senior and a Residential Advisor in the Quad, was completely surprised. Used to making appointments and talking with Student Financial Services, she had been at the office for a different reason when she also found out about her work-study grant.

Rachel was an RA, and in order to comply with federal regulations, SFS had cut her work study grant so that the amount of aid she received did not exceed her cost of attendance. But Rachel did not know any of this information until she walked into the office.

Stressed and frustrated,Rachel burst into tears in front of her financial aid counselor. Her counselor could only tell her, “Sorry, but I can’t help you.”

More than anything, Rachel was upset that she got the news six weeks into her senior year. Having been an RA last year as well, it bothered her that “they hadn’t told me that before I signed my RA contract for this year,” she said.

Like Rachel, several students interviewed by The Daily Pennsylvanian in 2014 said that they experienced problems in communication with SFS. The students, many of whom asked for their names to be changed to keep their financial situations private, said problems ranged from unclear messages about financial aid policies to a lack of transparency in how aid is calculated.

While SFS administrators said they have tried to communicate with students as quickly and effectively as possible, given the communication gap with several student RAs last semester — as well as issues regarding summer study abroad aid and unexpected loan cancellations — it is clear that issues still remain.

Connecting with students

While SFS uses a number of methods to communicate with students regularly, when situations outside the norm arise, communication can break down.

One source who has close knowledge of SFS, and wished to remain anonymous due to not being officially authorized to comment on such matters, said that the office’s weakness is communication.

A perfect example, he said, was what happened to RAs who lost their work study grants. “It has to do with when changes that are made that are not part of the standard process.”

John, a Nursing senior who is also an RA that lost his work study grant, said in a previous interview with the DP that he was upset with the delayed communication in his case. “If we’re not supposed to have work study because of whatever policy, first of all, that should be made explicit from the very beginning. Second of all, you can’t just do it part way through the year and make me change my plans,” he said. “My problem was that you didn’t tell me in June.”

Communicating with students is an issue not unique to Penn, and one that colleges across the country face.

Colleges generally have problems communicating financial aid policies with students in part because of the sheer volume of information they are required by law to send out, and in part because the language offices must use to describe their policies can be overly complicated.

“I think one of the biggest challenges that [a financial aid office] faces is that ‘What is the best way to communicate with students and make sure they actually see it?’” said Jesse O’Connell, assistant director for federal relations at National Association of Student Financial Aid Administrators.

To ensure students are understanding relevant financial aid policies at their schools, offices — including Penn’s — use email, snail mail and even social media to get information to students, O’Connell said.

The situation at Penn is not desperate. A 2013-2014 SFS customer experience survey shows that for the most part students are satisfied. For instance, 85 percent of respondents said they agree or strongly agree with the statement that “your experience with the SRFS representative ‘met my expectations.’”

But many students and two sources with knowledge of SFS’s internal operations still feel that issues in communication do arise. In another instance last fall, students were surprised to find out their loans had been canceled through an email from the loan office.

Wharton freshman Hannah Stulberg received an email in mid-October notifying that her loan had been cancelled. The loans were canceled because students, in accordance with federal regulations, have to pay a slightly higher origination fee for the loan after Oct. 1, and therefore had to reapply. It did not ultimately change anyone’s financial situation, but it did stress out students like Stulberg, who told the DP in October that she found her loan canceled out of the blue.

This was a case of a lack of internal communication, according to the source with knowledge of SFS. The loan office is housed under Student Registration and Financial Services, the larger structure which includes SFS, but the loan office is not a part of SFS. “The loan office sent that out without consulting us,” the source said.

SFS, in response to questions about how they communicate with students, said they send out information about changes in policy to students as soon as possible, through both email and hard copies of letters to students’ home addresses. “We’re trying to do everything we possibly can to give them the ability to see what changes have occurred,” Director of Financial Aid Joel Carstens said. He also points to the portal on Penn InTouch as another place where students can get information.

“Our greatest concern is to make sure that we’re doing everything we can to give our students the best information as quickly as possible,” Carstens added.

Misleading marketing

Problems in communication can also arise from students being unintentionally misled by the brochures and information packets sent to them before they get to Penn.

Anna, a College senior who transferred from a liberal arts college, said that she expected a lot of aid when she decided to come here because Penn had more resources. “I just sort of assumed they’ve got a lot bigger endowment. It seemed obvious that I would get more aid here.”

For Anna, it was not an unreasonable expectation, as Penn often advertises its financial aid budget and initiatives. President Amy Gutmann recently announced a new goal for the University to an additional $350 million in financial aid by the year 2020, and one of the first links on SFS’s website for parents leads to an article about financial aid featuring Gutmann.

“Penn’s No-loan Financial Aid Program for 2014-15 Backed by Penn’s Largest Financial Aid Budget,” the article’s headline reads. There are facts about this year’s financial aid budget for undergraduates: “$197 million — the largest in the University’s history” and “the program has helped to reduce the number of students borrowing today by 11 percent from those borrowing in 2008.” Penn is the largest university in the country to offer a “no-loan” financial aid policy.

Confronted with articles and language like this, Anna had expected a financial aid package. But she didn’t receive any aid from Penn because her family had assets — in other words, wealth that can be leveraged to get money to help pay for college.

Anna said she only transferred from the liberal arts college because she was not receiving enough aid there. But since coming to Penn, her parents ended up taking a line of credit against their home equity. And she’s receiving even less aid than at her previous school.

Penn says it will meet 100 percent of a student’s “demonstrable need,” but the key part is what SFS determines as one’s demonstrable need — the gap between the cost of attendance and this need is what a student and his family would end up paying. But if the expected family contribution is too high for the family to pay out of pocket, then students may have to take out a loan.

Barry Johnson, a College sophomore, said one of the main reasons he came to Penn was because of the no-loan policy. But he ended up with a loan (a relatively small one) in his sophomore year, which seemed contradictory to him.

“They do give good financial aid, but that no-loan policy is something SFS needs to work on,” he said, because some students who go to Penn will take out loans.

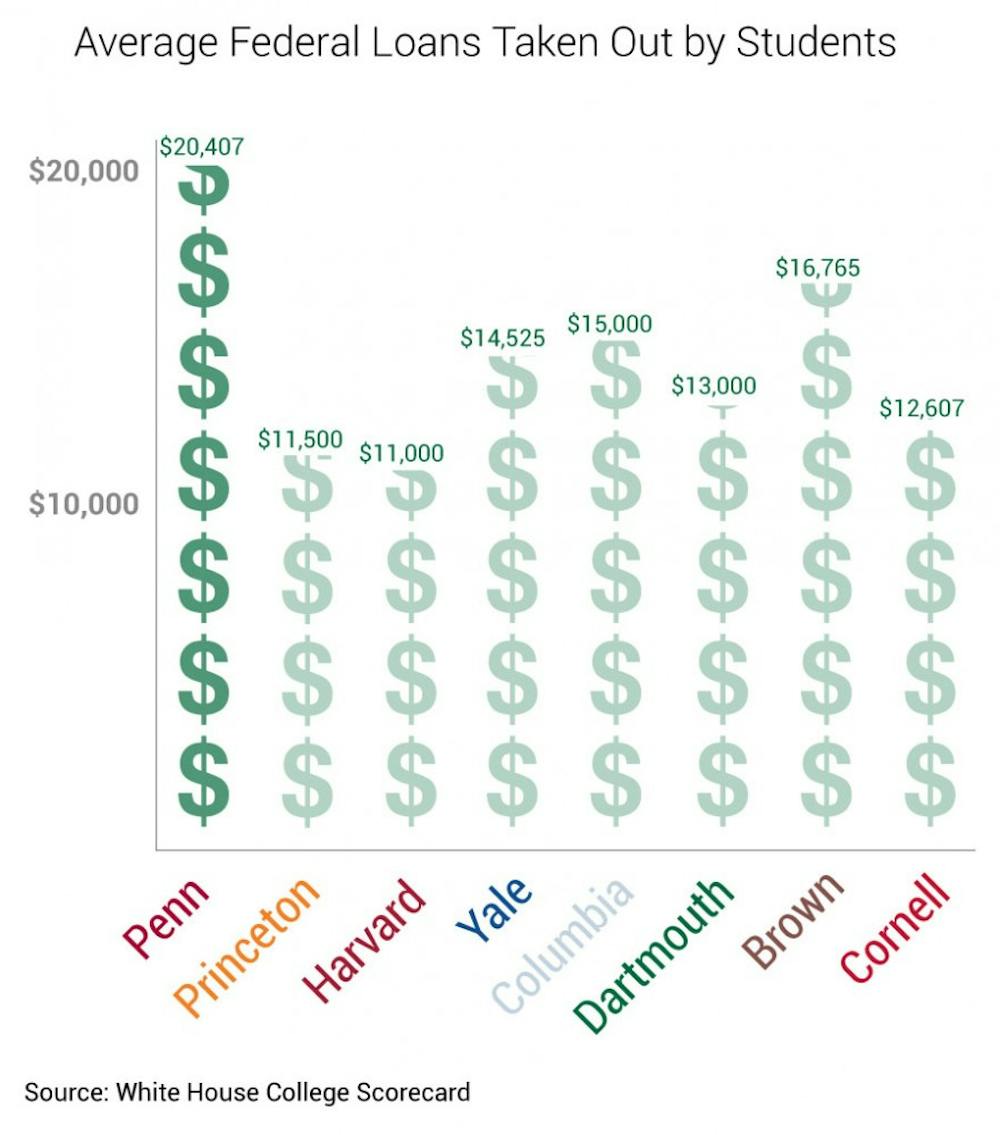

According to the federal government’s college scorecard, Penn students take out an average of $20,407 in federal loans, the highest amount in the Ivy League. That compares to Harvard’s $11,000 in loans, Dartmouth’s $13,000 and Brown’s $16,756.

“You can make it very clear during the materials you send out to prospective students: You may accumulate loans,” said Jesus Fuentes, a former United Minorities Council board member and a College senior.

A turnaround

SFS has come a long way since the late 1990’s, when it was severely understaffed, said sociology professor Camille Charles, who was part of a committee in the late 1990’s on pluralism and issues affecting students. One of the contributing factors to student retention was financial aid.

Back then, Charles said, she would have students coming to her during her pre-freshman program who were concerned about their aid packages, before they even officially started college. She used to buy course books for students.

In a more extreme case, professor Herman Beavers, chair of undergraduates and graduates in the Department of Africana Studies, said he had a student who had to work 35 hours a week at a full-time job. He reached out to SFS on her behalf and was able to help her resolve her financial aid situation.

SFS responded to the critiques quickly then, Charles said. At the time, for students on financial hold who tried to purchase items through their bursar accounts, an alarm would sound indicating the charge could not go through. After hearing recommendations from the committee, including Charles, SFS replaced the system with a more discreet notification. The institution also hired more staff and changed its name.

This year, SFS has a budget of $197 million for undergraduate financial aid, a number which Carstens said has grown every year in the past few years.

“I think no system is really going to be perfect, but my sense is that things have gotten substantially better,” Charles said.

Closing the gap

For its part, SFS has been increasing its work with students. It recently announced the creation of the Student Financial Aid Advisory Board — an initiative that was led by the 5B, the five different umbrella groups for minority students. UMC was one of the groups on campus who brought about the creation of the student financial advisory board because of complaints from its constituents. This was also the case for other 5B groups like the Lambda Alliance.

“I think SFS is really starting to get it more and they’re really starting to try to make efforts,” said Undergraduate Assembly president Joyce Kim, a College senior. Kim was one of the students who had initially brought about the implementation of the board. “They’re being a lot more proactive.”

The advisory board is meant to address the issues of transparency and communication that students have raised. The idea was first brought up in December 2013, and the board had originally planned to launch in last fall. It was delayed, partly due to a lack of response on the part of administrators, and is expected to launch in January. The resolution for the board passed in the UA on Dec. 7.

The board, though an important step forward, is not the saving grace. Fuentes said that those on the board may not be the students who really need to be heard, because those who do have severe financial constraints are usually working 15 to 20 hours a week or maybe even a full-time job. “Often times these students should be speaking about it, but they don’t have the time,” he said.

Even if the numbers of students affected are small — and there’s no way to get an accurate count on how many students have had problems with SFS — it is still important to address these concerns, Fuentes said.

“I’ve never had my aid withheld from me; I’ve never had to fight for my work study grant,” he said. “Just because it worked for some of us, doesn’t mean we should be satisfied with that.”

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

DonatePlease note All comments are eligible for publication in The Daily Pennsylvanian.