Graduate students at Penn could stand to lose almost 40 percent of their income under the proposed Republican tax plan.

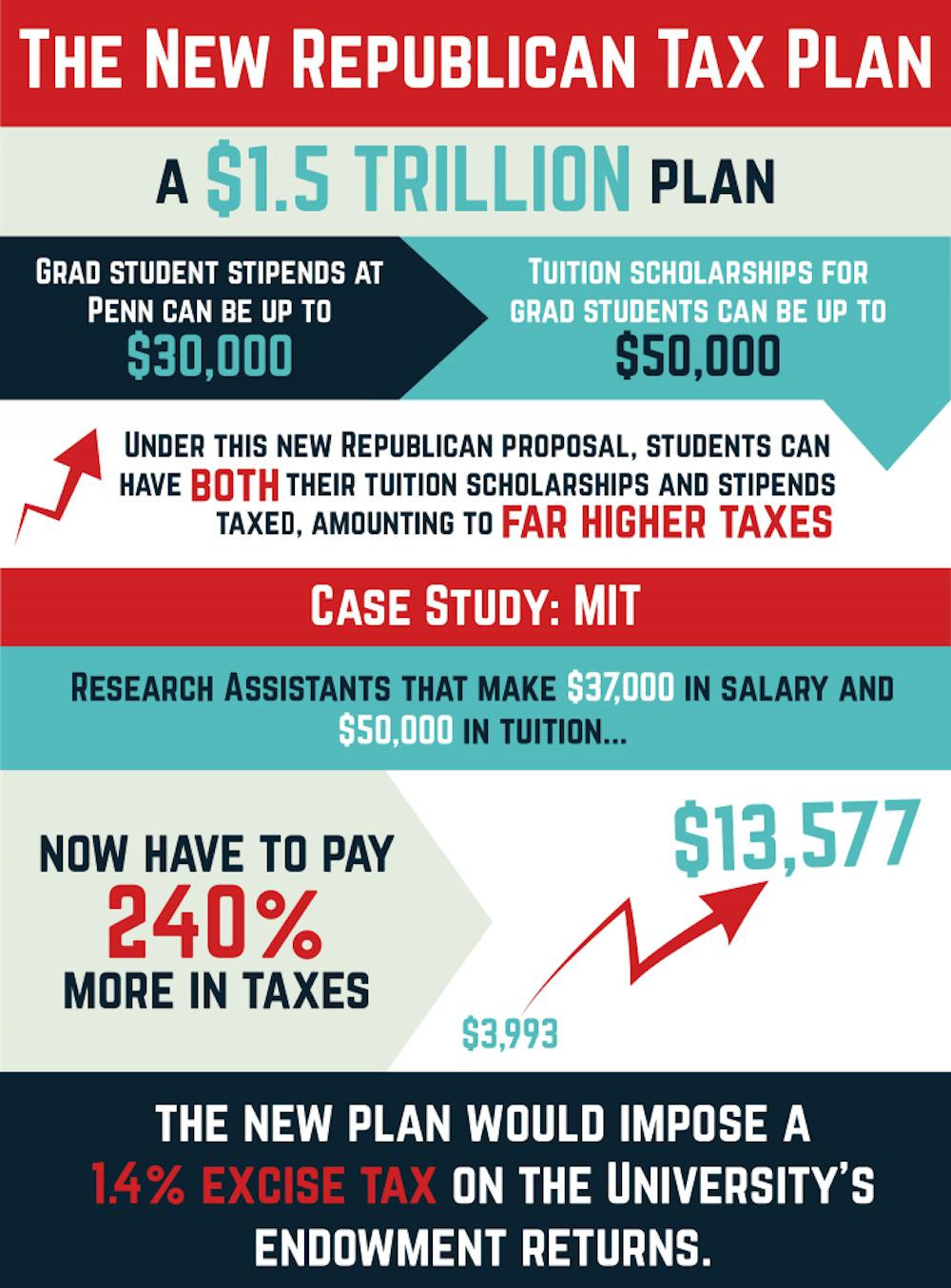

The tax proposal, which was unveiled early this month, is a $1.5 trillion plan that entails a rewrite of the current tax code. It could deliver significant cuts in the corporate tax rate — a reduction from 35 percent to 20 percent — and various new taxes for universities. On Nov. 16, the House of Representatives passed the bill with a vote of 227-205, bringing it one step closer to implementation.

Penn President Amy Gutmann, Provost Wendell Pritchett, and Executive Vice President Craig Carnaroli have called the plan “regressive” in an email, which also encouraged students to vocalize opinions on the proposed measure.

"We are working closely with our peer universities and professional groups to inform elected officials of our concerns and to emphasize the value to our country of support for higher education,” the email read.

One of the communities that stands to lose the most is graduate students. The proposed policies would tax the scholarships that graduate students use to pay for tuition as regular income, making graduate education unaffordable for many.

Graduate students, particularly those in Ph.D. programs, usually receive a teaching or research assistantship stipend which is valued at approximately $30,000. Along with this stipend, many Penn Ph.D. students are also granted tuition scholarships, which can amount to almost $50,000 based on the field of study.

The increase in taxes is rooted in changes made to what is considered "taxable income," explained Graduate and Professional Student Assembly President and third-year Design and School of Arts and Sciences professional graduate student Miles Owen.

Currently, only graduate student stipends, which are approximately $30,000 at Penn, are subject to tax. But under the new Republican proposal, both graduate student stipends and their $50,000 tuition scholarships can be taxed, which means they would have to pay significantly more on their income.

In addition, a study conducted by University of California, Berkeley Ph.D. student Vetri Velan found that the tax plan will affect graduate students at private universities like Penn more dramatically than those at public universities. At the Massachusetts Institute of Technology, which Velan used as a case study, research assistants who make about $37,000 and approximately $50,000 in tuition will have to shell out nearly 240 percent more in taxes. Under the new plan, their taxes would grow from $3,993 to $13,577.

Penn graduate students may also face significant changes in their taxes, though not all students will be equally affected.

At Penn, graduate students are paid differently across schools and departments. Some students will be subject to increased taxes on both their tuition scholarships and stipends, which will pose a significant financial burden, Owen said. Others, who pay taxes only on their stipends, will be affected less by the new Republican plan.

“You would not be able to make a living wage off of graduate stipends,” Owen said about the new proposal. “You’d have to be independently wealthy to pursue graduate studies."

Penn, as an institution, could also lose substantial funding under the tax proposal. While private institutions are currently exempt from taxation on their investment income, the new plan would impose a 1.4 percent excise tax on the University's endowment returns. According to The Atlantic, “endowments are tax-exempt funds, including donations and investments, that colleges and universities manage over many years to pay for a wide range of expenses.”

Economics professor Petra Todd said this aspect of the proposed tax plan should be manageable for the University.

“I think it’s within the range of something they might normally experience just because of fluctuations in investment returns, but it’s still going to be a big shock if they suddenly impose a tax like that on the endowment,” Todd said.

Economics professor Harold Cole said it is difficult to predict the University’s reaction to the proposed taxes on its endowment. After the recession in 2009, state colleges increased their tuition after budget cuts. Cole said this is a trend that Penn could follow.

“Forecasting this thing is very difficult, but I would view that as suggestive evidence,” he said.

Dirk Krueger, who is the Interim Department Chair and a professor of economics, echoed this and added that the hit to Penn's endowment might prompt the University to reduce financial aid. He added that he does not believe the demand for a Penn education would change, but is concerned that decreasing financial aid could affect the demographic of applicants to Penn.

However, Todd said Penn is likely to cut programs or freeze faculty hiring before changing financial aid policies or raising tuition.

Since the tax plan was unveiled on Nov. 2, it has received widespread criticism on campuses nationwide. On Nov. 13, students at Ohio State University organized a protest against the proposed bill. Administrators at Harvard University, Yale University, and Cornell University have also made statements addressing concerns over the impact of the tax plan on students, particularly those in graduate programs.

“We’re working with the administration and we’re working to call local politicians to voice our opinion that passing this proposal would have a huge impact,” Owen said. “We are emphatically opposed to this tax proposal.”

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

Donate