From all-expense-paid trips for financial aid officers to kickbacks for universities who recommend certain lenders, the problems in the student-loan industry run much deeper than those universities that voluntarily chose to settle Monday.

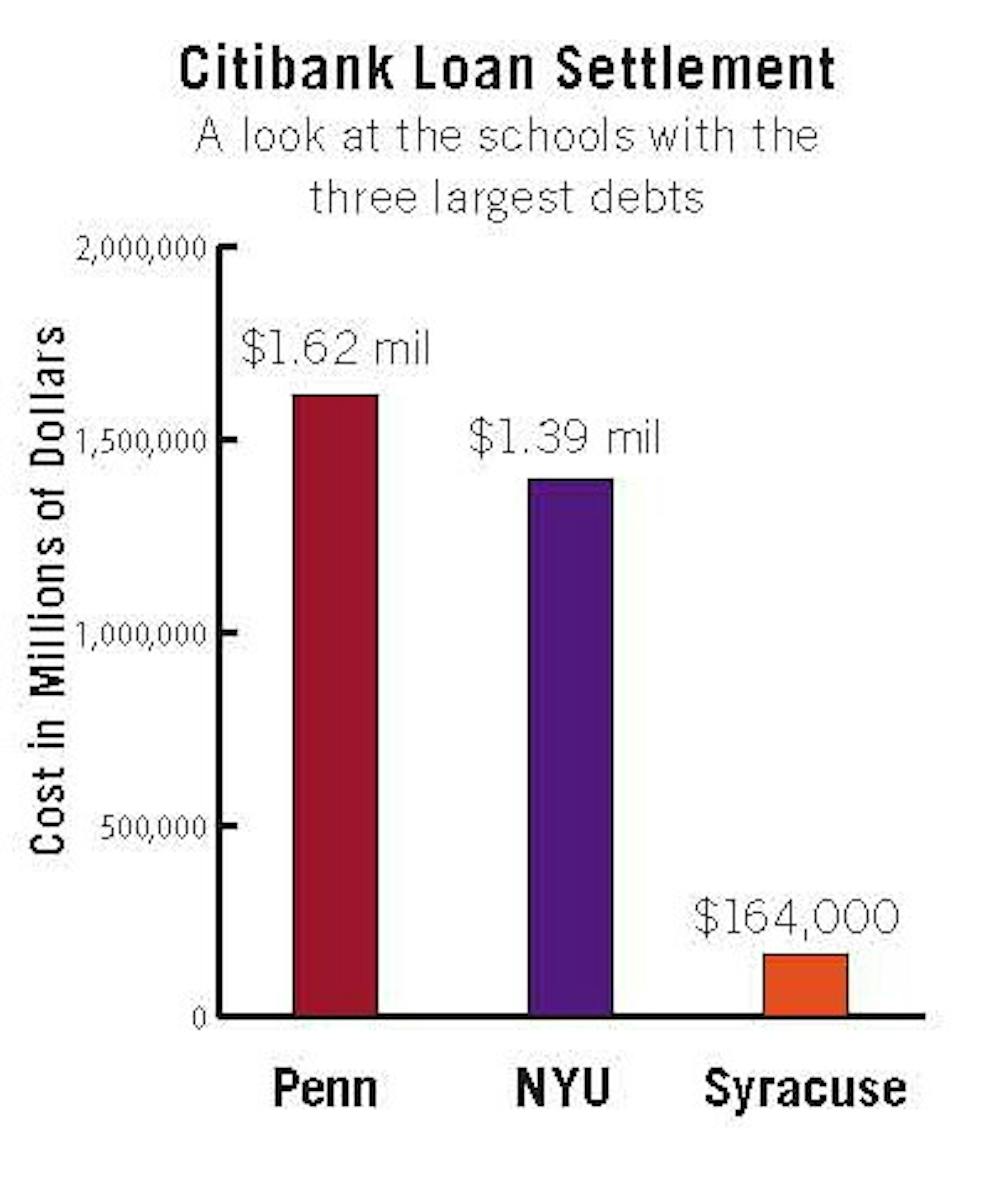

Penn reached a $1.6 million agreement with New York Attorney General Andrew Cuomo Monday after the University had failed to disclose its relationship with Citibank's student-loan program, CitiAssist. CitiAssist, which is one of Penn's preferred lenders, had paid the University two percent of each loan that students took out.

Following the settlement, the University will continue relationship with Citibank, but will not accept the 2-percent fee.

In total, Cuomo settled with 35 universities, redistributing $3.27 million to students whose loans were part of similar university-lender revenue-sharing agreements over the past few years.

But Cuomo isn't stopping there.

"The Attorney General's office is actively investigating more than 100 schools and more than six lenders," Attorney General spokesman Lee Park said.

Park could not offer more specifics on which schools or lenders are still under scrutiny, but Cuomo has publicly stated that he will also file a lawsuit against another student loan provider, Education Finance Partners, for engaging in similar practices.

"There is an unholy alliance between banks and institutions of higher education that may often not be in the students' best interest," Cuomo said in a press release. "The financial arrangements between lenders and these schools are filled with the potential for conflicts of interest."

For example, some schools have outsourced their financial-aid call centers to lenders. Lenders have also gone so far as to send financial aid officers on all-expense-paid trips to exotic destinations or to provide other gifts in exchange for directing students to their company.

Executive Vice President Craig Carnaroli stressed that Penn was not involved in any of these "much more egregious" practices.

"The idea that you call a call center, and you have a representative of a certain bank that answers - we don't have that, and I don't want to be swept into that," Carnaroli said.

Park could not comment on just how widespread these illegal practices are but said the Attorney General's "investigation is very wide in scope, and we're finding all sorts of things regarding these relationships."

New York University and Syracuse University, which both chose to settle Monday, along with Penn, were also targeted by Cuomo for their relationship with Citibank.

NYU had a revenue-sharing agreement with Citibank that was very similar to Penn's, in which they received 0.25 percent of the value of certain Citibank loans.

"We believed it made good sense to use money that would otherwise go into Citibank's pockets to give more financial aid to NYU students," NYU spokesman John Beckman said in a statement.

NYU will redistribute $1.3 million to students who have received specific Citibank loans over the past five years.

But some organizations think Cuomo is making a big deal of a relatively small problem.

Cuomo "needlessly tore the fabric of trust between schools and students . with his inflammatory press statements and media comments," the National Association of Student Financial Aid Administrators said in a statement.

Carnaroli neither agreed nor disagreed with NASFAA's assertions but said that, in terms of Cuomo's involvement, "there are clearly broader issues at play than the mere practices themselves," referring to the fact that many have questioned whether Cuomo's actions are politically motivated.

But at the end of the day, the University still maintains its stance.

"We have a relationship of trust here that we need to respect and recognize, and that's why we can't afford even the appearance of impropriety," Carnaroli said.

The Daily Pennsylvanian is an independent, student-run newspaper. Please consider making a donation to support the coverage that shapes the University. Your generosity ensures a future of strong journalism at Penn.

DonatePlease note All comments are eligible for publication in The Daily Pennsylvanian.